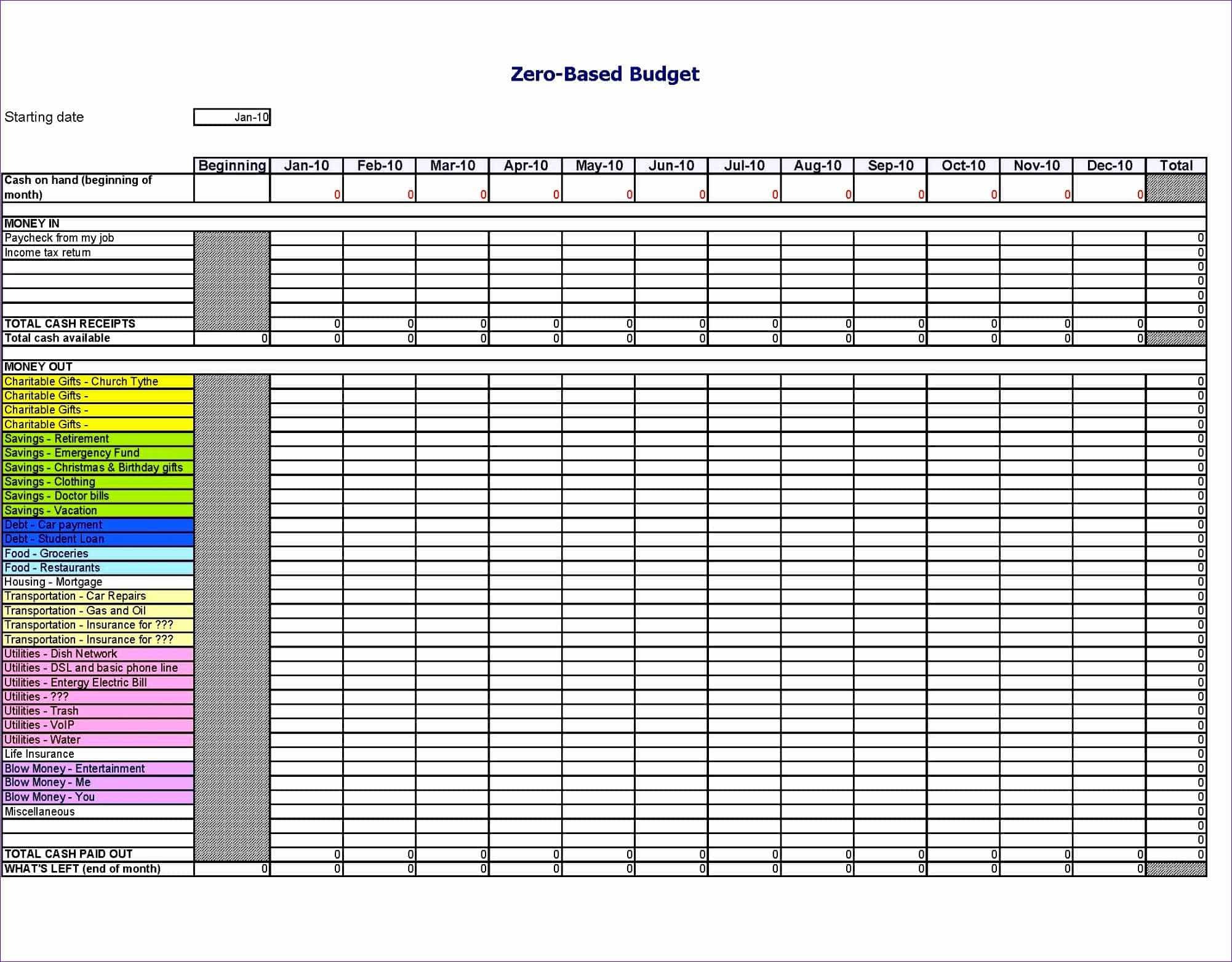

This table shows you how much extra repayment money you have (the amount you have budgeted monthly to pay off loans – the sum of the minimum payments of your loans). There’s no need to touch the third table.In the second table, enter the amount you have budgeted to pay off your debt.After downloading the spreadsheet, enter all of your debts in the first table.This spreadsheet by Squakfox will help you determine how much to pay off each month for each loan you have. Once you’ve entered all of this in, the spreadsheet will tell you how much you need to retire (B20) and the age you will be able to retire (B14).Everything else will be calculated for you. Enter your current age (B13), current monthly expenses (B18), and yearly additional investment (E3).You will add/subtract rows from the existing list under “Investments” so that the spreadsheet matches exactly what you have.But the information is useful regardless of whether or not you want to retire early. The blog post specifically talks about retiring early.I recommend using the original spreadsheet because it is simpler. You will find the original spreadsheet and the updated spreadsheet.I highly recommend first reading the blog post.Here’s what you need to know when using this spreadsheet: And the spreadsheet is simple enough to use and understand. The blog post explains all of the terms and sections in the spreadsheet. Retirement planning is too important to leave off of this blog post. Most of what I found wasn’t self-explanatory and required a bit of prior knowledge of personal finance terms. I spent quite some time looking for a free retirement planning spreadsheet. The spreadsheet will total up your fixed expenses and give you the amount that will be left over for unfixed expenses.List your unfixed expenses (food, activities, etc).For example, if you are headed to Austin, TX, you can look up, “average cost of hotels in Austin, TX.” If you are unsure of how much to budget for these fixed expenses, you can google the average cost of the expense at your destination.Enter in your fixed expenses (hotel, flights, etc) by adding or subtracting to the existing rows.

Enter your destination, number of vacation days, and total budget.Here’s how to use the travel spreadsheet: This is a very simple but effective travel budgeting spreadsheet. This can help prevent you from spending money frivolously.Allocate each dollar you make to an expense category.This will help you see if your spending habits align with your life priorities.See the percentage breakdown of where you spend your money.If you are continuously overspending, it could be a sign that you need to start paying for your expenses with cash.Compare your actual spending to your goals.With this simple budgeting spreadsheet, you can easily: Monthly personal finance budget spreadsheet

0 kommentar(er)

0 kommentar(er)